Words by Deborah Pitcairn, Director of College Counseling

Every student and family has its particular goals and priorities regarding the pursuit of higher education. Some are concerned more with career training goals and getting a job in their field as soon as they graduate. Others aspire to a broader, liberal arts experience and degree that will more likely enable them to advance farther in their careers, but may deliver a more uncertain immediate outcome upon graduation. Most students are somewhere on a spectrum of these aims; we all must surely learn to adapt, to be critical and creative thinkers, and to be problem-solvers, but we would be foolhardy to ignore the realities of the economy.

A higher education is an investment in your future and the future of your (future!) family. It is wise to approach this significant investment as you would a home or car or other large purchase – choosing the best college you can afford rather than the best at which you can be accepted. Too often, the reasons cited for choosing a particular college are shallow, emotional, even romantic. Maybe there is a beautiful quad with old trees and Georgian buildings. Maybe there is a brand-new, state-of-the-art athletic center. Maybe there is a dining hall that serves 9 different ethnic cuisines, has a soft-serve ice-cream machine and a 40-foot long salad bar! Maybe there is even a well-respected, prestigious name. There are many reasons we purchase the things we do; appearance and comfort are definitely important ones. However, although a certain house may pull at our heartstrings and a certain car or even washing machine might excite us with its style, we also consider practical things in making our decision: Is it durable and reliable? How much will I spend in upkeep, maintenance, gas or energy, insurance, etc.? How well does it perform? What will its resale value be? We consider all these points and make a decision on the overall value we perceive. For choosing a college, the best value means we want to balance the potential to discover and develop ourselves and find what makes us happy with things like cost, debt burden, and future earnings potential.

To research Return on Investment (ROI) and Best Value colleges, try these articles and websites:

How Do I Apply?

Financial Need is the difference between the Total Costs of Attendance at a particular college/university (tuition and fees, room, board, books, transportation) and a student’s Student Aid Index (SAI), determined by the FAFSA, plus any outside funding sources or scholarships:

A student’s SAI (Student Aid Index) is determined by filling out online the Free Application for Federal Student Aid or FAFSA. The federal government then calculates the amount a family is expected to contribute toward the cost of college. Because many variables go into the calculation of the SAI, a family cannot project their SAI based on income alone.

Factors that are considered include:

- number of children in the home

- parental and student assets

- business values/losses

- significant health care costs

- amount of debt

The SAI is the same for every college the student applies to, regardless of the cost of the school. The form must be submitted every year the student is in college.

Net Price Calculators can help you estimate the cost of attendance at a particular school. By law, every college/university has one on their website. If you have questions, you can call the financial aid office of the school.

You can also fill out a practice FAFSA online to get an idea of what your SAI might be.

You must apply for financial aid with each school. Follow their application and document requirements and deadlines exactly. If you don’t understand the website, call the Financial Aid office and ask. The first step will be to fill out the FAFSA online. If you are applying to public school(s), that may be all you need to do.

Many private colleges require the CSS Profile, found on the College Board website. They may also need various documents, like tax returns and W-2 forms, or have an institutional application. Although there will be many similarities among schools’ requirements, each school is different, and you should treat each as unique.

How is My Need Met?

When everything has been submitted, the school will send you a Financial Aid Package. It will be comprised of several possible components: Gift Aid, made up of grants and scholarships, and Self-Help Aid, made up of work-study programs and loans. Not every college/university is in a position to promise to meet the full need of its students. Therefore, there may or may not be a gap.

The sticker price of a school is not necessarily what you will pay. Once you receive your financial aid proposal, figure out what the total cost of your schooling will be at the school, including out-of-pocket payments and future loan payments. Closely compare the bottom lines of your options; it is sometimes the case that the school with the highest price tag may not be the most expensive one for you to attend. Find the school that fits you and then find out what the cost will be; don’t assume you can’t afford it until you find out. The scholarship website, Going Merry, can help you interpret and compare financial aid packages. It also has tips and templates for appeals to colleges for additional aid.

How Can I Benefit from Differential/Preferential Aid Packaging?

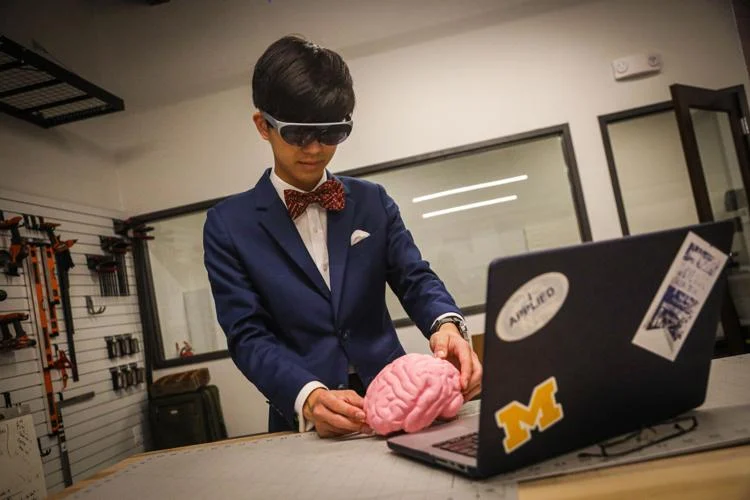

Students receive the most generous financial aid packages from schools that really want them. A school can offer a student more grant aid and less loan aid to make the school a more attractive choice. Therefore, the stronger you are in a school’s applicant pool, the more likely you will be offered a more advantageous aid package, including more merit scholarship and grant aid and less of a student debt burden. This is how high academic scores, athletic prowess, or other talents can help you, not only in the admissions process, but in the financial aid area as well.

Finding the best value and fit in a college does not mean being accepted at the most prestigious school on your list. It means finding a place that will help you fulfill your goals for higher education and your career while making the cost manageable for your family and not saddling you with crippling student debt. It means finding a place where you will be offered opportunities to learn, practice, expand and develop your skills and talents and where you will be given the tools and support to successfully take the next step in your life and career. Keeping an open mind and being flexible when researching schools will present you with many “good value” options for college.